Tony asked about where to start with a VPS so I thought I’d do a short guide to getting the set-up I have.

Here are some previous blog posts on the subject-

VPS – includes Mike’s contribution

VPS active – My initial VPS package and MSOffice

Api delay testing – The improvements measured

From VPS to Cloud Hosting – Another step forward

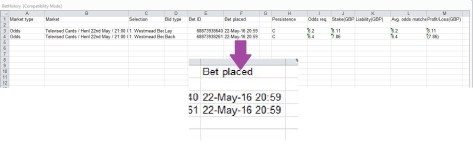

To get the cloud VPS, go to Tagadab and choose what spec you want by moving the slides This is what I selected –

Then on the next page, I choose Windows server 2012. I don’t know what the difference is between 2008 and 2012 but 2012 sounds better to me. There are some other options on the page but I didn’t select any. This gives a monthly price of £15 including VAT.

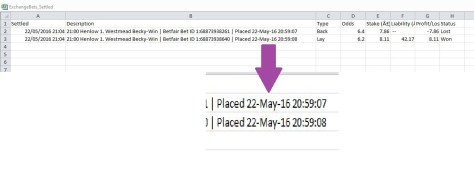

Click on the “Create Virtual” button and on the next page, check everything and click “buy”. You’ll get the emails telling you they’re on with it and then one telling you it’s ready. My VPS took about 15 mins to be ready, on a bank holiday. Log into your account on-line and click on your server icon –

Then click on the green connect tab –

In the pop-up you can download the RDP file which makes connecting to your server a doddle. This puts an icon on your desktop. Just open it like any other icon and away you go.

You can open IE to download apps. Files can be transferred by simple copy/paste as the clipboard is shared between your PC and the VPS

Here’s a short video of connecting to the VPS Opening VPS from desktop. Hope this helps.