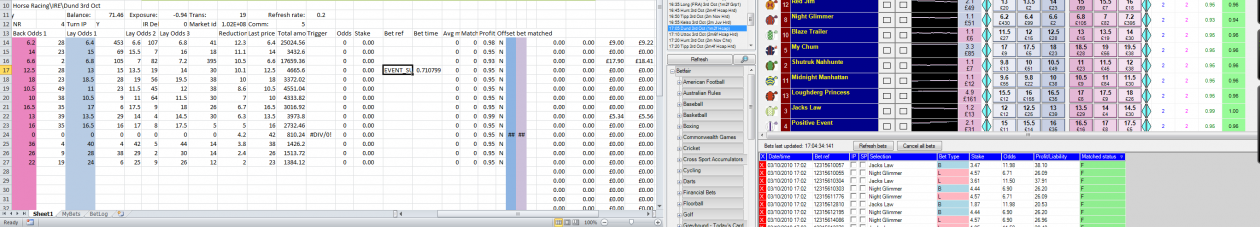

I’d traded the aus horse racing markets with my previous bot a few years ago, it made sense to give the bot something to do during the night if I was going to leave the computer running. Back then most of the parameters were in cell formula and started with an if statement to determine whether the market was a dog or horse event. Different settings were used depending on the type of event.

When I started up again this year, putting all the program into VBA, I hadn’t allowed for the different event types and the result was I gave up on aus shortly into the project. I’ve now modified the code to allow for different event types.

The settings I’m using for the aus horses are taken from the last couple of months of the old bot. They’re a lot more restrictive of market entry conditions, waiting for more activity than the dogs before starting to trade.

From what I’ve seen, there seems to be a lot more money on the aus horse markets than I remember. I had traded the UK horse win markets with my first ever bot but found the trading too complex for my simple strategy. That’s when I moved to dogs and then aus. I have trialled my scalping bot on the UK horse place markets and depending on aus results, may try aus place markets. First things first, see if I’ve a bank left in the morning.