First up – FastTrade.

This was intended to be trading for a few weeks until my new bot – Volt – was up and running, more on that below, but for now it’s still my non-stop bot.

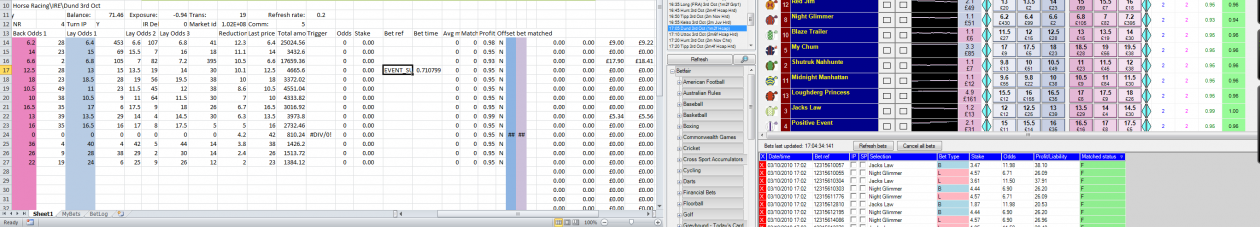

The data is thin on this one due to my minimal code. From the results, I get a good idea of what’s going on. There’s a gap in my model. I’ve always noticed this gap. It is between what I watch and predict some trading code will do, and what it actually does once running.

My data suggests I should be able to trade in around 40% of the markets I monitor. When I open the parameters to do this, I see more losses. When I tighten the parameters, there’s fewer trades and more profits, and I’m only entering around 15% of markets. But I’m struggling to see the difference between some of the made trades and some of missed ones. However, my data isn’t robust enough to be conclusive, so I might be way off with my thoughts.

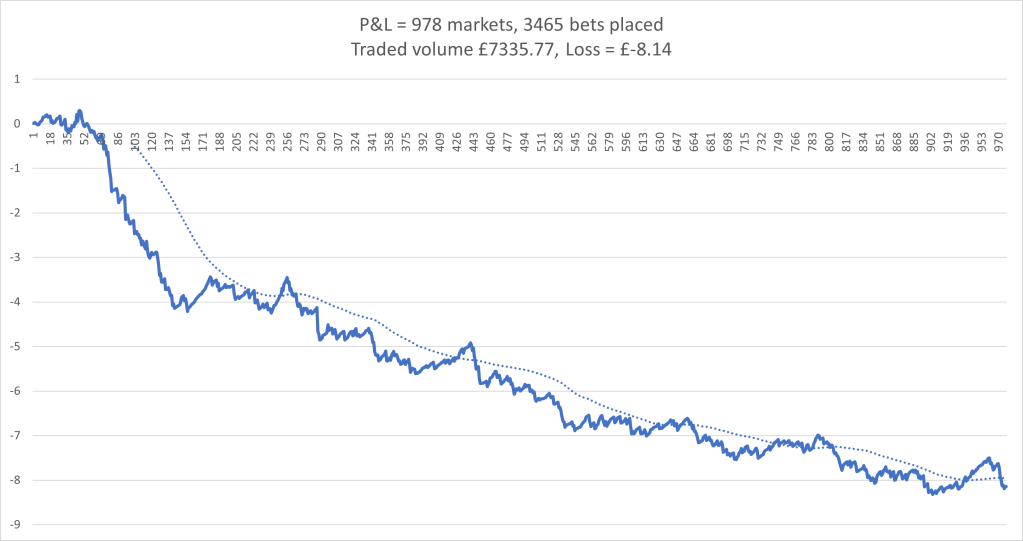

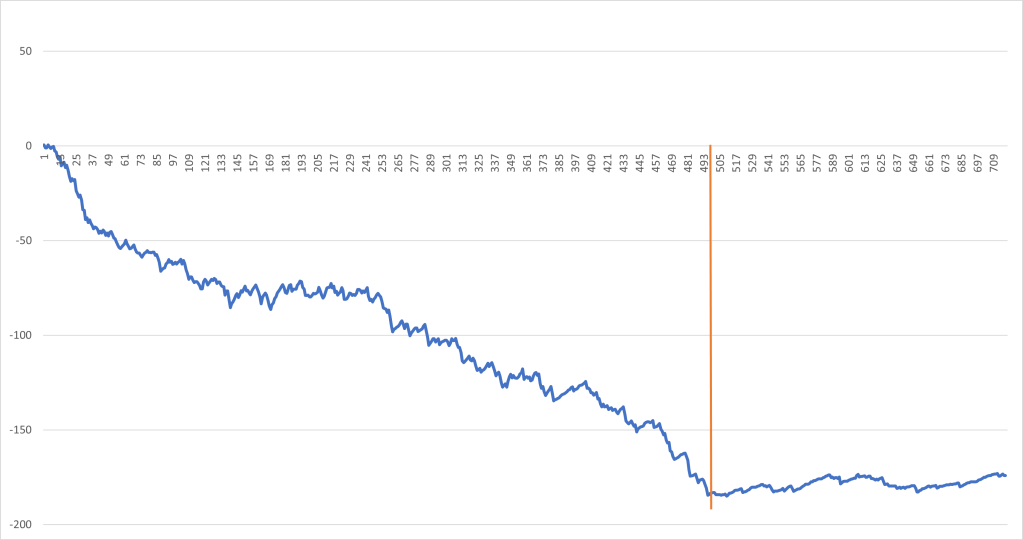

Here’s a chart from the past few weeks, the orange line indicates the point where my last significant change was made. Results after this are more positive and steady.

As for Volt, it’s a work in progress. I run it live for a few markets on my laptop, not the VPS, review the results and run again. This allows me to gather more data and then continue with the building process.

My idea with this bot was to find the trades as I built the code, and I am getting somewhere, but it’s not giving me the activity I want quick enough, and I’m starting to think of other possible angles.

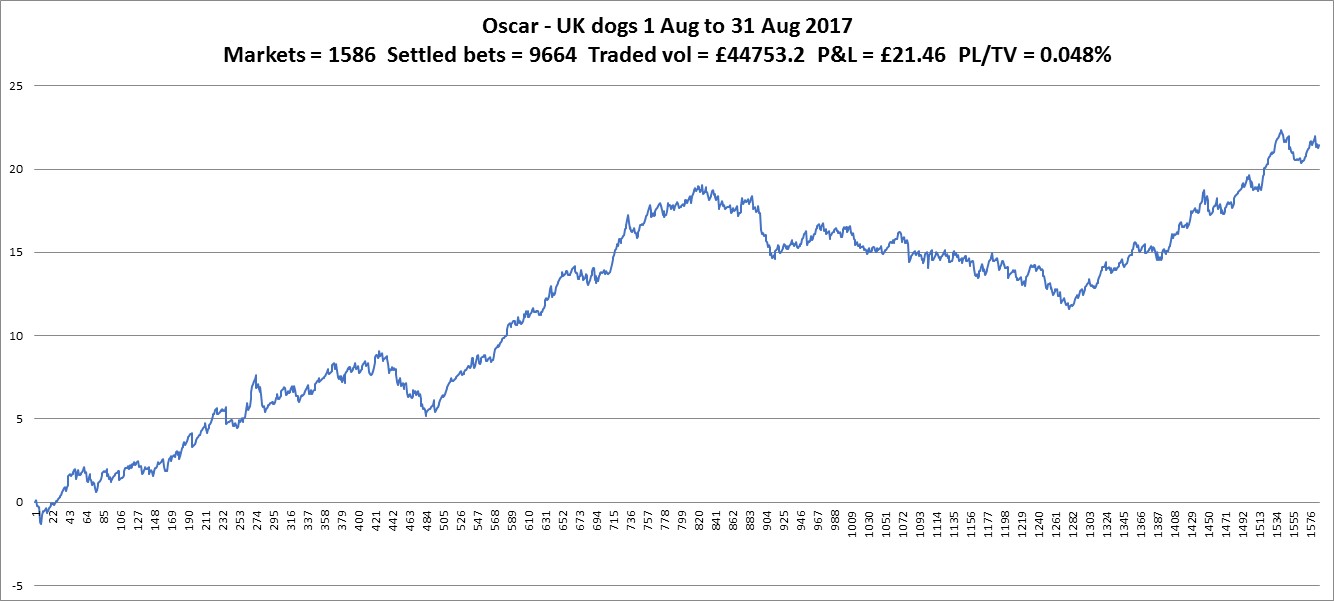

My most successful trading has come from statistical models with a bit of technical analysis thrown in, trading the moves in the markets around various indicators. My ventures into fundamental trading, looking at runner and track stats, has never really produced anything. I have enjoyed writing the data gathering code for this analysis and think there’s probably some value in what I’ve got, but I haven’t found it yet.

Still, happy botting everyone!