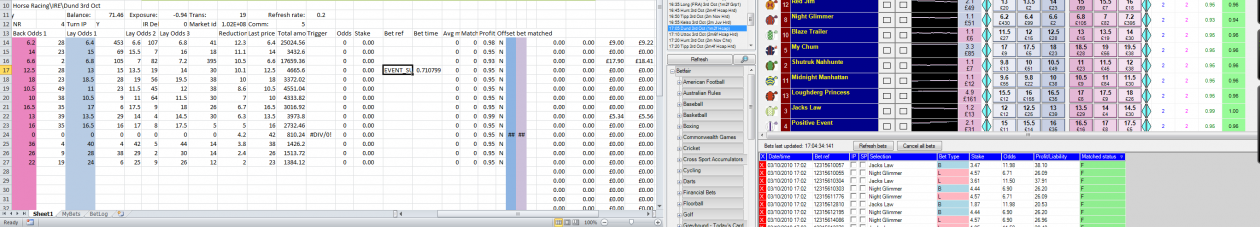

Work on the VB bot was frustrating me so I decided to pause it and have a play with Oscar, my VBA bot. I’ve nearly always run one instance of Oscar, navigating between different markets and sports based on some preset criteria. I decided to split the sports, running an instance for UK dogs and one for Aus horsies. This has the benefit of not missing conflicting events across the two sports. The reason Oscar didn’t do this originally is because back in the day, Betfair charged for making excessive calls above a relatively low amount. This changed some time back but I hadn’t.

This new set-up runs well and so I added Aus dogs, also running in its own instance. And why not US horses? OK, they are now covered in another instance. (Previous attempts at US horses had not seen many trades but most races were missed in favour of the other markets.)

I’ve monitored some cross-over times on the VPS and I haven’t seen any drop in performance. At some points in the morning, three of the bots are running at 0.2s refresh rate but I’m still getting a delay of less than 20ms on each.

I did notice the other day that the US horses were buggered by some error in the stated off time. For one venue the times were in the quick pick list but when the markets were selected, the off time was around an hour and a half out. This may have been an API issue but if I see it again I’ll look at coding to handle the mismatch between the two.

Next, Chris commented on Speedy data 2 –

Very interesting articles about bot speeds. I have been looking into the same. I have looked at my algorithms and have improved them. They now return values within 3-4 ms. However the main bottle neck is the price refreshes. Without streaming they currently have a price refresh at 200ms, my prices can be 180 ms out of date. If I was able to implement streaming I could improve my robots speed by a huge amount (probably 100ms), dwarfing any gains that could be made over optimising my robots. So I would suggest that the bottleneck is in your price refreshing and you could see a large improvement with your bots if you were able to stream prices.

Thanks for the comment. 3-4ms is fast and I haven’t seen those speeds from my bots yet. How are you timing the code? And what language are you coding in? The arrival of streaming made me less eager to push on with the VB bot as I don’t want to put all the time in to get the code perfect just to see it become old-hat overnight. Gruss, the software I use for my VBA bots, are releasing a beta streaming version soon. When I’ve had a go with that, I’ll look at how to stream with VB. There’s no point at all in not streaming if it’s faster and as reliable (collective eye roll) as the API-NG.

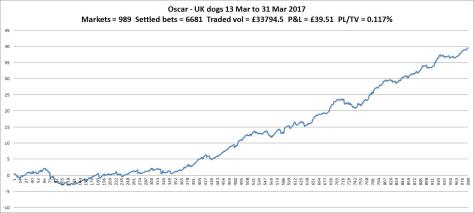

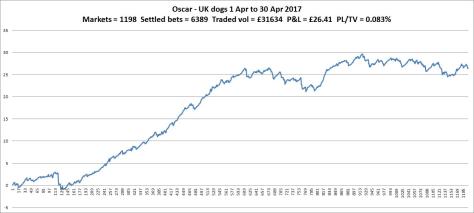

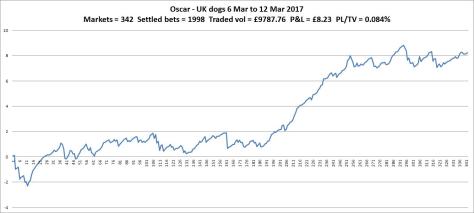

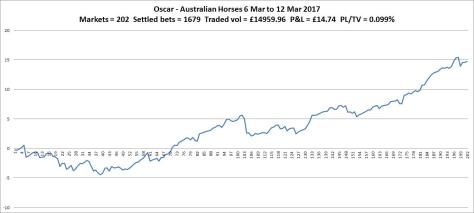

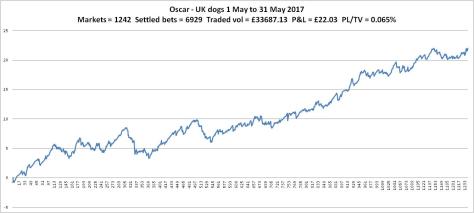

And now, some charts.

UK dogs have done ok, nice steady performance.

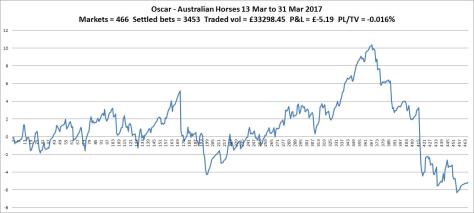

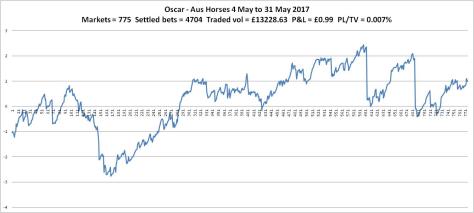

Aus horses continue to throw some bad results. The three sharp drops in this chart have different causes. The first is actually 3 losing markets together, so no problem there. The second was an error, a problem I haven’t seen for a while where an extra lay is submitted for some reason. I’ve previously thought this is down to timing and the bot missing signals at specific points, eg when greening occurs and a bet is taken at the same time as a CANCEL-ALL command is triggered. The third was just a bad run of multiple bets being placed within the stoploss window, all eventually losing trades. When I’ve attempted to overcome this particular event in the past, the number of trades significantly reduced. I may look at this again, specifically in the Aus horse markets, but with a more complex solution.

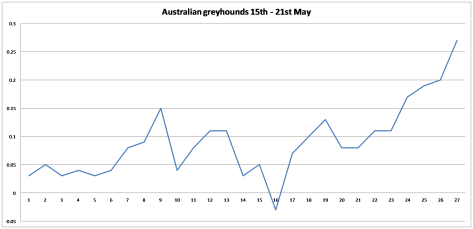

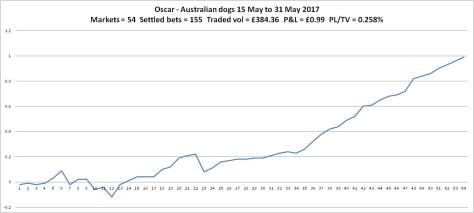

NEW – Aus dogs, although not many markets, has a good looking chart, certainly one to watch. Stakes are still hovering around £2 for now.

NEW – US horses, only 3 days here so wait and see what happens in June. Interesting to see average bets per market at 9.9, with other sports being

UK dogs = 5.6

Aus horses = 6.1

Aus dogs = 2.9

You can find all of Oscar’s UK dogs charts on a single page now – see here.