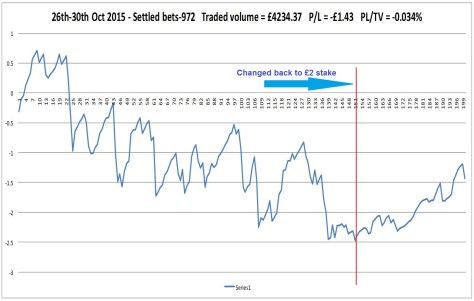

A good early run kept the rest of the month in profit. From around the 1000 point the staking plan was changed and there is a noticeable difference in the loss impact. the rise at the end reflects the move back to the original staking plan.

Tag Archives: betfair

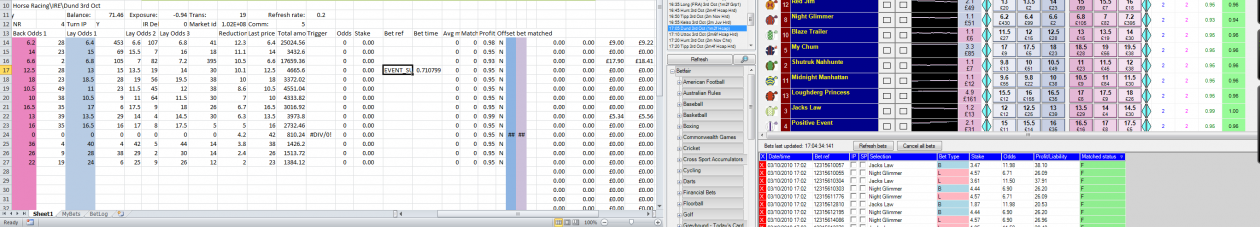

More trades.

The bot has run since Saturday and it’s slowly drifted downward. I’ve been a bit puzzled by the results as initially there was an upward trend. As the changes have been made its gradually switched to a net loser. To stop this I’ve adjusted back to settings I’d used at first but still no joy. This week’s settings were the same as those that saw the most consistent profit and so far the bank hasn’t really changed.

There was one thing that was different though. I’d had a problem with missing greening trades. To solve this I prevented the bot from trading again on a selection before the tick offset or stoploss had been matched.

Thinking this through I could see the possibility of missed opportunities on strong weight and also potential trades occurring within the stoploss zone. Obviously there’s also the possibility of more losing trades based on spoofing. I still think that the opportunity of spoofing by others is limited by the fact that they don’t know any more than anyone else which way the market will go. Yes they can trigger some quick trades but their hope is that their spoof is to suggest a wrong movement. If their spoof is on trend it doesn’t really have any effect on me.

Well I changed it late last night and the last few events saw increased activity. Maybe things will turn out good.

Short week ending 30-10-15

I wont be able to get to computer for a few days but wanted to share this weeks progress so far.

I adjusted the stake, on Thursday evening, back to a flat £2 after thinking that the current poor performance was related to the last staking plan change. As can be seen on the chart there was an immediate change in trend, the losses were less significant. I still think that the flat £2 (or any set number) is a bit crude and there may be a better way of staking but I need to do some proper testing and checking before implementing. For example around the whole numbers, ie at 2.00, 3.00, etc, the change in step per tick from say 0.02 to 0.05 can mean a disproportionate loss at 3 ticks than profit from 1 tick.

Stake mistake

I changed my stake amount from flat 2 quid to amount based on current odds. I just made it up without checking, thinking I knew already. So it works as

xstake/(current odds – 1)

No checking or testing. Just threw it in. Performance since had been flat. I’ve looked at all sorts. Then I thought “hold on a minute, this started when I changed staking plan.” I’ve just done some calcs and found that it doesn’t work quite like I thought.

Changes will be made. Tests will be done.

New battery!

This is what gets me going. I tested my UPS the other day and it managed 1 minute before starting shutdown procedure. My pc runs at around 120 watt so the UPS should give at least ten minutes before low-battery status kicks in shutdown. So I ordered a new battery. £9.95+vat. Look at it, all shiny and new, just waiting to provide stand-by power. Happy days.

Let it run

I should really let it run. After looking back over last two days I decided to change settings, then adjust after one event, then adjust again. That’s not how it works and I know this. Only after a lot of markets have been traded can any idea of effectiveness be established. So I’ve set it back to how it was this morning and it can run for the rest of this week.

Restricting entry points

I’ve spent a few hours analysing past data to see if restricting price entry points would have any effect. On each day I checked, today, Friday, Wednesday and the previous Wednesday(crash day), all had better outcomes and also more consistent p&l movement as shown on a graph.

In particular, crash-day went from large loss to above average gain. Number of bets reduced between 25% and 50%.

A major flaw was discovered in the code today. An if statement which had been copied and pasted was incorrectly edited, basically resulting in no lay-then-back trades. IMPORTANT NOTE always double check each line of code AND run the code through each possible flow!!!

Betfair down

Today (24th) saw a major outage for betfair with lots of people complaining on Twitter and the forums. It’s one of those things you can’t plan for, well, not easily.

Anyway, I managed to come away unhurt.

It’s unimpressive that betfair has these problems. I can’t remember hearing that financial exchanges are down. Also that bets placed near to outage, where the player is unsure as to whether it is valid, is allowed to stand. When the outage causes such turmoil in the market, bets should be void from a preset period before, then people know where they stand and can take action with other providers. Betfair’s stance towards traders is a little disrespectful. With a large amount of turnover, and therefore liquidity, attributable to traders, their position of “well bettors don’t look to trade out” stinks. Until more move to other exchanges though, this is how it will stay, you get what you’re given so belt up.

Resistance points

Further to my last post, I’ve observed more losses at resistance points. Two noticeable ones today backing at 4.3 which is roughly 100/30.

I just need to spend some time analysing effects on winning trades.

Trading at whole numbers

I’ve just been analysing today’s results and focused on an issue I’d previously thought about. That is entering a trade at a whole number. This is the point at which there is likely to be more resistance. Other points could be corresponding odds values e.g. 4.5 as 7/2, 3.25 as 9/4, etc. Today ended down but if no trades had been at whole numbers, it would have ended slightly up.

I won’t change it yet, I’ll keep an eye on it.