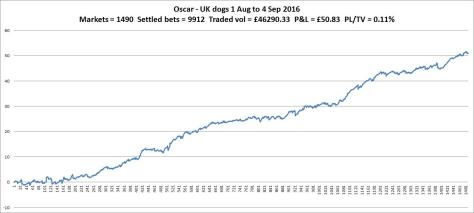

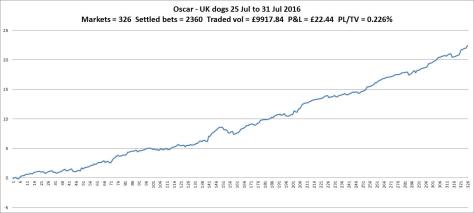

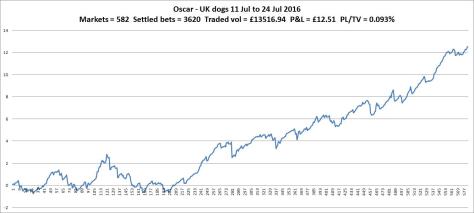

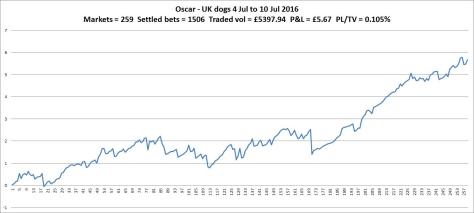

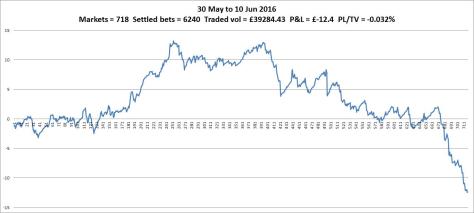

I’ve set myself a challenge on the UK greyhounds to get from a starting bank of £20 to £300 in 1 year!

To avoid falling into the trap of setting a challenge and then erasing it from history when it goes pear shaped (like so many others), I kept this beauty quiet for one whole year. I think you can see where I’m going with this. Yes, success (I may have given some clues in my previous posts).

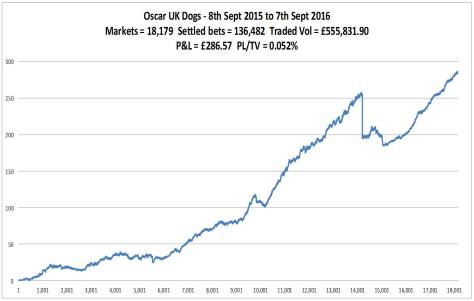

My Oscar has managed to rake in a profit of £286.57 on the UK dogs after commission. Added to the starting bank of £20, I’ve smashed the challenge target, ending with a balance of £306.57, kerching.

Details if chart is poor –

- Markets traded = 18,179

- Settled bets = 136,482

- Traded volume = £555,831.90

- P&L = £286.57

- Return on traded volume = 0.052%