Results

In a change to previous reporting I am moving from week/weeks to monthly stats. And no charts. Here are the results from March, beginning to end –

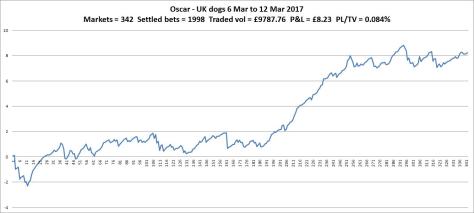

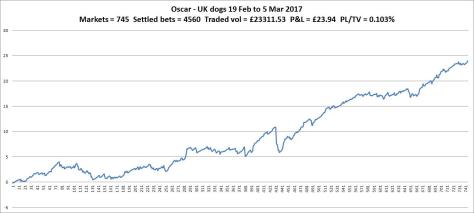

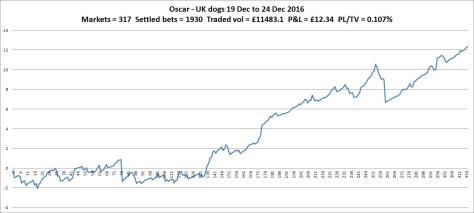

UK Dogs Initial slow start to the month but then went on to a steady return. Overall good result with no changes to be made.

Markets = 1595

Bets = 10409

Volume = £51949.79

Profit = £59.65

Return = 0.115%

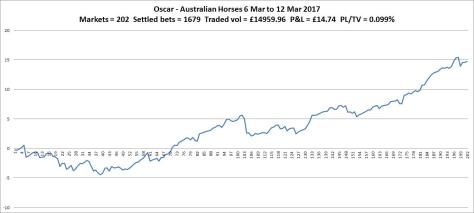

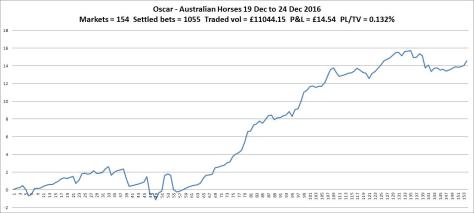

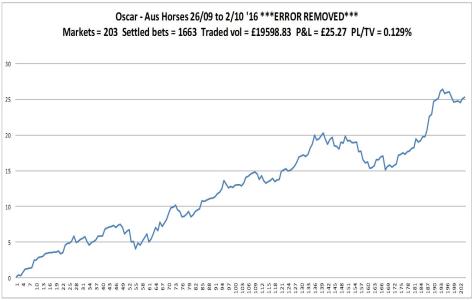

AUS Horses The first half of the month saw profitable trading but the second half was all over the place with regular enough runs followed by sharp drops, streaks of losing markets, with no further profit added (this has been the same for the start of April). If this continues I will pause Aus trading.

Markets = 821

Bets = 6606

Volume = £62277.75

Profit = £26.55

Return = 0.043%

The API crashing should have very little effect on a bots overall profitability other than the fact you’re missing out on opportunities when the site’s offline.

In a way, I agree. If I have an open position when the crash happens, I will either win or lose an unusually large amount for me. If this happens regularly, then, so long as I have enough cash in the bank, these wins and losses should roughly balance out. (This is stretching the view of chance and puts a lot of hope on a balance being seen across a relatively low number of events. I’d rather not rely on this to cover the effect of crashes.) Steve continues –

Every bet you place with a bot should be sent because you believe it to be value at that time and it should be allowed to stand on it’s own merits.

I think at this point Steve has missed my approach to the markets. With regards to the outcome of the event, I have no idea if my entry point is at “value”. This is because I have no interest or care of the event. It matters nothing to me if it’s dogs, horses, pigeons, camels, Pooh sticks or bottled messages that are racing. I am trading on the market movement, not the event. I believe my entry point has a statistical positive value if I can exit shortly after. Therefore, I never want a bet to stand “on it’s own merits” because it doesn’t have any merits (on it’s own). Look at it like this – I think the price is shortening and assume that there are willing backers and layers in the market. I effectively jump in between a backer and a layer, giving them both slightly poorer odds than they could have got and skimming a little bit for myself. That’s how I see it. Steve goes on –

I can understand the mentality of wanting a green book at the off but trading will always be easier to do manually rather than having some set time or ticks to balance your bets.

I disagree. Steve finishes with –

There’s a lot of easy money to be made botting don’t go wasting your time trying to tick for pennies.

In short – “trading will always be easier to do manually” even though “There’s a lot of easy money to be made botting“. With that logic any mouse clicking screen watcher should be raking it in. This I doubt. And the idea of any easy money left on the exchange is one I don’t believe. But if you have found it, screw it for every last penny and don’t tell anyone.